Tax Management Market Insights and Growth Trends 2025 –2032

"Executive Summary Tax Management Market Trends: Share, Size, and Future Forecast

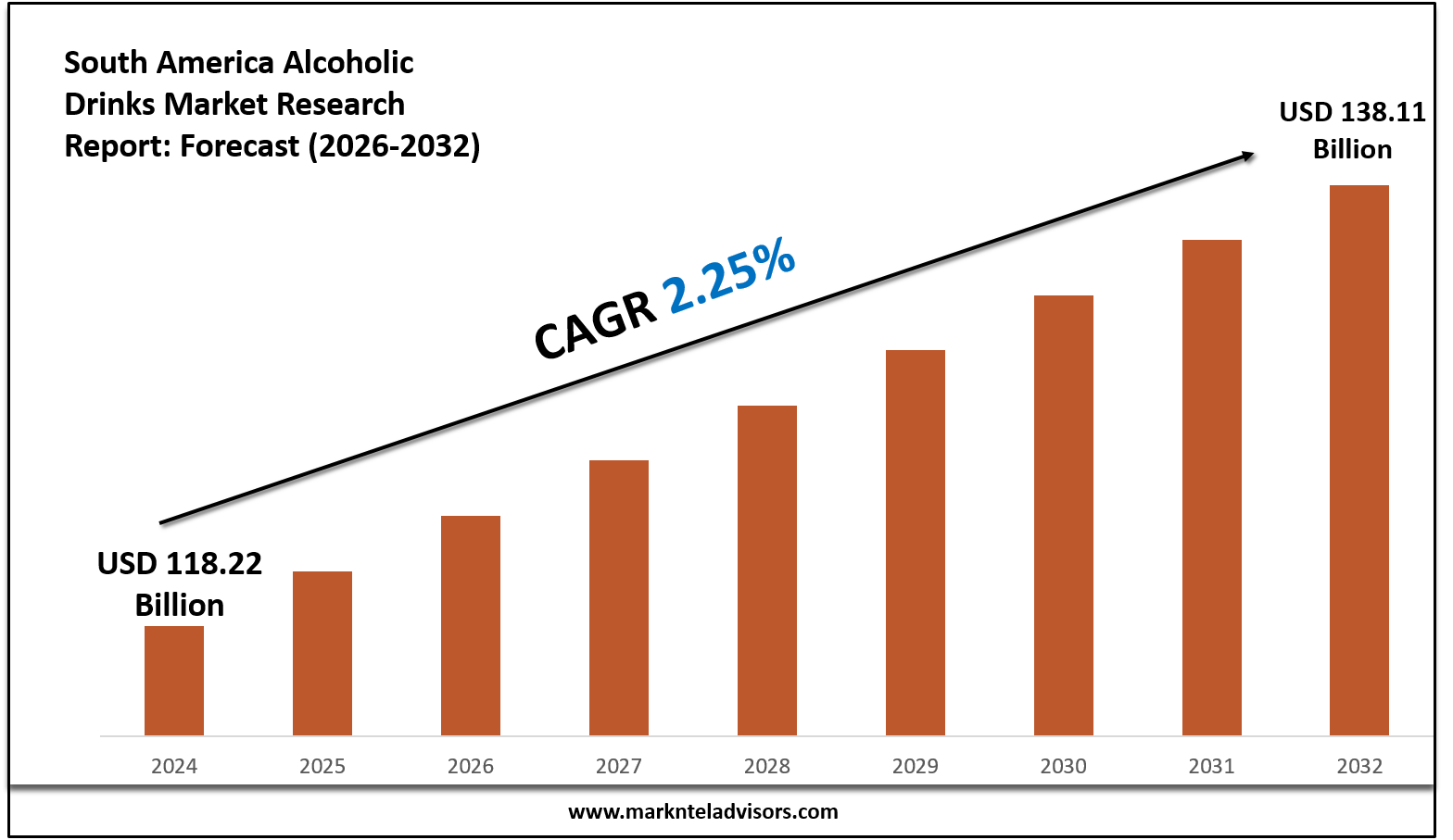

CAGR Value

The tax management market is expected to witness market growth at a rate of 11.20% in the forecast period of 2021 to 2028.

By working with a number of steps of collecting and analysing market data, the significant Tax Management Market research report is framed with the expert team. Being an outstanding resource of market info, the report provides recent as well as upcoming technical and financial details of the industry. The market study and analysis of this business report also lends a hand to figure out types of consumers, their views about the product, their buying intentions and their ideas for advancement of a product. The world class Tax Management Market report comprises of various segments linked to Tax Management Market industry and market with comprehensive research and analysis.

An all-inclusive Tax Management Market research report directs the manufacturer about planning of advertising and sales promotion efforts and makes it more effective. The report consists of all the detailed profiles for the Tax Management Market’s major manufacturers and importers who are influencing the market. This market survey report provides key information about the Tax Management Market industry such as helpful and important facts and figures, expert opinions, and the latest developments across the globe. An influential Tax Management Market study includes drivers and restraints for the market along with the impact they have on the demand over the forecast period derived with the help of SWOT analysis.

Examine detailed statistics, forecasts, and expert analysis in our Tax Management Market report. Download now:

https://www.databridgemarketresearch.com/reports/global-tax-management-market

Tax Management Sector Overview

Segments

- On the basis of component, the global tax management market can be segmented into software and services. The software segment is further categorized into cloud-based and on-premises software. The services segment includes professional services and managed services. The increasing adoption of cloud-based solutions is driving the growth of the software segment, as businesses seek more flexible and scalable tax management systems. Professional services are in demand as organizations look for expert guidance in navigating complex tax regulations and ensuring compliance.

- By tax type, the market is segmented into income tax, consumption tax, and other taxes. Income tax management dominates the market due to its widespread application across industries and regions. Consumption tax management is gaining traction with the shift towards indirect taxation in various countries. Other taxes such as property tax and sales tax also contribute to the market growth, as businesses seek comprehensive solutions to manage their tax liabilities effectively.

- Based on deployment mode, the market can be classified into cloud and on-premises deployment. Cloud deployment is witnessing significant growth as organizations embrace the scalability, cost-effectiveness, and agility offered by cloud-based tax management solutions. On-premises deployment still retains relevance for businesses with specific security or compliance requirements that necessitate an on-premises infrastructure.

Market Players

- Some of the key players in the global tax management market include Thomson Reuters, Wolters Kluwer, Avalara, Intuit, H&R Block, SAP SE, Deloitte Touche Tohmatsu Limited, Ernst & Young Global Limited, KPMG International, and PwC. These market players are actively involved in strategic initiatives such as partnerships, acquisitions, and product innovations to strengthen their market presence and offer advanced tax management solutions to customers. The competitive landscape is characterized by intense rivalry and a focus on delivering value-added services to meet the evolving needs of businesses in a dynamic regulatory environment.

The global tax management market is witnessing a profound shift towards cloud-based solutions driven by the increasing need for flexibility and scalability among businesses. Cloud-based software is gaining traction over traditional on-premises solutions due to its ability to offer real-time updates, accessibility from any location, and lower upfront costs. Businesses are looking to streamline their tax management processes, and cloud-based solutions provide the agility required to adapt to changing tax regulations and compliance requirements. As organizations strive to optimize their tax strategies and enhance overall efficiency, the demand for cloud-based tax management software is expected to continue its upward trajectory.

In addition to software solutions, the services segment of the tax management market is experiencing growth as organizations seek expert guidance in navigating complex tax regulations. Professional services such as tax consulting, compliance support, and audit assistance are in high demand as businesses aim to ensure accurate reporting and adherence to tax laws. Managed services are also gaining prominence as companies look for outsourced solutions to manage their tax functions efficiently. The services segment complements software offerings by providing tailored support and expertise, thereby enhancing the overall effectiveness of tax management strategies.

Income tax management remains a dominant segment in the market, given its widespread application across industries and geographies. Businesses are increasingly focusing on optimizing their income tax processes to minimize liabilities and ensure compliance with ever-changing tax laws. Consumption tax management is also on the rise, driven by the global shift towards indirect taxation in various jurisdictions. Companies are recognizing the importance of effectively managing consumption taxes to mitigate risks and enhance financial performance. Other tax types such as property tax and sales tax are contributing to market growth as organizations seek comprehensive solutions to address their diverse tax requirements.

The competitive landscape of the global tax management market is marked by intense rivalry among key players seeking to enhance their market presence and offer cutting-edge solutions to customers. Companies such as Thomson Reuters, Wolters Kluwer, and Avalara are at the forefront of innovation, leveraging strategic partnerships, acquisitions, and product advancements to stay ahead in the market. With a focus on delivering value-added services tailored to the evolving needs of businesses in a dynamic regulatory environment, market players are driving innovation and setting new benchmarks for tax management solutions. As the market continues to evolve, organizations will increasingly turn to technology-driven approaches to optimize their tax processes and achieve greater operational efficiency.The global tax management market is experiencing significant growth and transformation driven by evolving industry trends and the increasing complexity of tax regulations. Businesses across various sectors are recognizing the importance of adopting advanced tax management solutions to streamline their processes, ensure compliance, and optimize their tax strategies. As organizations face a dynamic regulatory environment and the need to effectively manage tax liabilities, the demand for innovative software and services in the tax management sector is on the rise.

One key trend in the market is the shift towards cloud-based solutions, which offer scalability, flexibility, and real-time updates for businesses. Cloud-based tax management software provides organizations with the agility needed to adapt to changing tax laws and compliance requirements efficiently. The lower upfront costs associated with cloud deployment make it an attractive option for businesses looking to enhance their tax management processes while reducing operational expenses. As a result, the adoption of cloud-based tax solutions is expected to continue growing, driven by the desire for more accessible and cost-effective tax management tools.

In addition to software solutions, the services segment of the tax management market is also witnessing growth as businesses seek expert guidance and support in navigating intricate tax regulations. Professional services such as tax consulting, compliance assistance, and audit support are in high demand as companies strive to ensure accurate reporting and adherence to tax laws. Managed services are becoming increasingly popular as organizations look for outsourced solutions to efficiently manage their tax functions and improve overall operational efficiency. The combination of software and services in the tax management market provides businesses with comprehensive support to address their diverse tax requirements effectively.

Income tax management continues to be a primary focus for organizations due to its broad application and significance in financial planning. Businesses are placing emphasis on optimizing their income tax processes to minimize liabilities and stay compliant with changing tax regulations. Consumption tax management is also gaining traction globally, fueled by the shift towards indirect taxation in various jurisdictions. Companies are recognizing the importance of effective management of consumption taxes to mitigate risks and enhance financial performance. Other tax types such as property tax and sales tax are contributing to market growth as organizations seek integrated solutions to manage their various tax obligations efficiently.

The competitive landscape of the global tax management market is characterized by intense competition among leading players striving to enhance their market presence through strategic partnerships, acquisitions, and product innovations. Market leaders such as Thomson Reuters, Wolters Kluwer, and Avalara are at the forefront of driving innovation and delivering value-added services to meet the evolving needs of businesses. With a focus on providing cutting-edge solutions tailored to the dynamic regulatory environment, market players are setting new benchmarks in the tax management sector. As organizations increasingly adopt technology-driven approaches to optimize their tax processes, the market is poised for further growth and advancement in the coming years.

View company-specific share within the sector

https://www.databridgemarketresearch.com/reports/global-tax-management-market/companies

Strategic Question Sets for In-Depth Tax Management Market Analysis

- What is the reported value of the Tax Management Market?

- How is growth in the market expected to evolve annually?

- What submarkets are examined within the broader Tax Management Market?

- Who are the major firms setting industry trends?

- What recent advancements are influencing Tax Management Market dynamics?

- What nation-specific insights are provided in the Tax Management Market report?

- What part of the globe is currently expanding fastest?

- Which country will hold the dominant market role?

- Which market area has the greatest share today?

- Which country is showing record-high CAGR trends?

Browse More Reports:

Global Tantalum Market

Global Telecom Analytics Market

Global Thermoset Composites Market

Global Trauma Fixation Market

Global VCSEL Market

Global Wall Décor Market

Global Wired Headphones and Earphone Market

Middle East and Africa Cargo Inspection Market

Middle East and Africa Chronic Disease Management Market

Asia-Pacific Coding and Marking Systems Market

Middle East and Africa Industrial Ethanol Market

Europe Industrial Valves Market

Europe Medical Aesthetic Market

Saudi Arabia and GCC Modular Construction Market

U.A.E. Mushroom Cultivation Market

Middle East Vertical Multistage Pumps Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com